Statement on principal adverse impacts of investment decisions on sustainability factors

Background and scope

This statement applies to ODIN Forvaltning AS and describes how we consider the principal adverse impacts of our investment decisions on sustainability factors in accordance with Article 4 of the EU Disclosure Regulation (EU Regulation 2019/2088).

The Disclosure Regulation stipulates requirements for information to be provided on the sustainability of financial products. This disclosure requirement covers climate and environmental impact, social and employee-related issues, respect for human rights, and anti-corruption work.

This statement is effective as of 15/06/2023 and will be revised on an annual basis.

Description of the principal adverse impacts on sustainability factors (i.e. PAI indicators)

In line with ODIN’s current Sustainable and Responsible Investment Policy, sustainability considerations are integrated in all investment decisions, including through monitoring violations of international norms, active ownership and exclusion criteria. This policy is available in full here.

The PAI indicators are a standardised method of measuring the principal adverse impacts of our investment decisions on sustainability factors. We aim to minimise such adverse impacts.

ODIN assesses the principal adverse impacts on sustainability at entity level and applies the PAI indicators to ESG analysis at fund and mandate level.

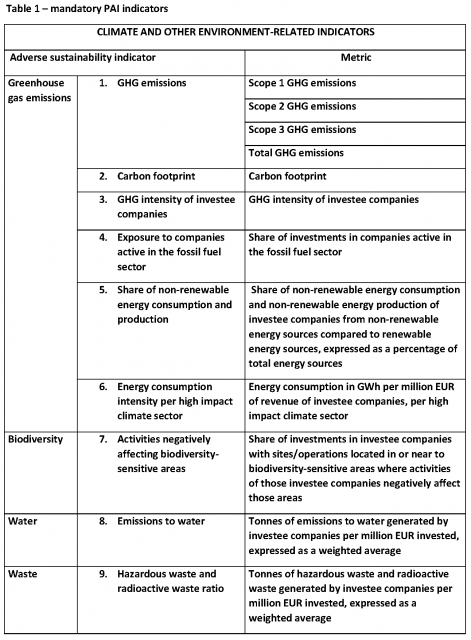

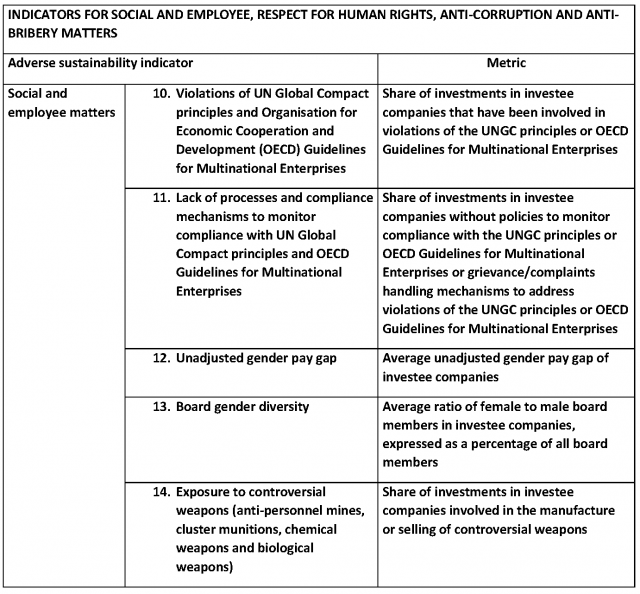

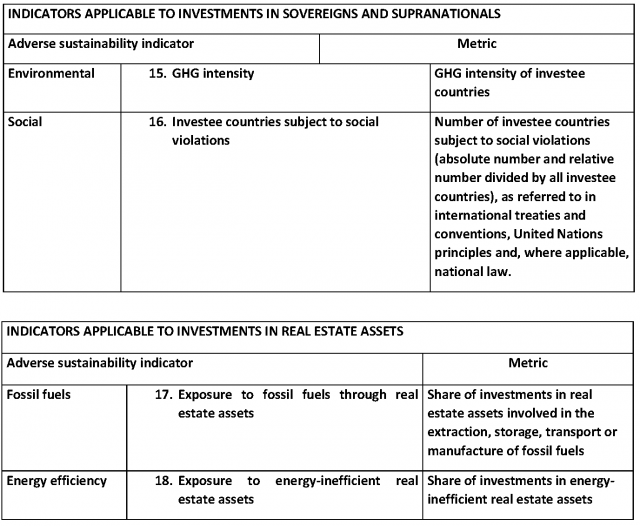

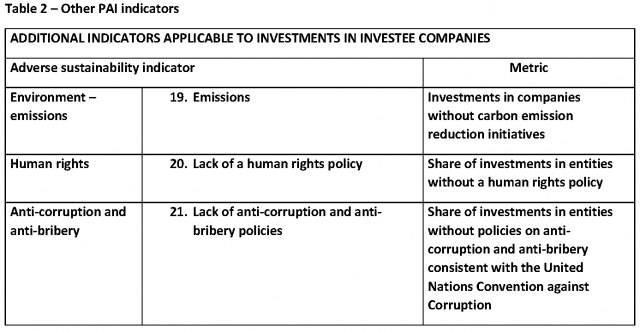

ODIN will collect PAI data on all the mandatory indicators as well as three additional indicators as set out in Table 2. The list of PAI indicators will be reviewed annually and updated as access to and quality of data improves.

The following mandatory PAI indicators are monitored and assessed:

In addition, the following PAI indicators are monitored and evaluated:

General guidelines for identifying and prioritising adverse impacts on sustainability

With the assistance of our ESG team, our asset managers regularly monitor the selected PAI indicators for individual investments in our funds and investment mandates. This is done in order to identify actual adverse impacts on sustainability factors among our investments, or increased risk of such adverse impacts, and is based on either internal analysis or data acquired from a third-party provider. If such an adverse impact or increased risk of adverse impact is identified in one of our investments, the investment will be subject to an internal assessment and a decision taken on appropriate measures, such as dialogue with the company or divestment.

PAI data is used by our asset managers in the ESG analysis of our investments and is an integral part of the investment process.

Methodology for mapping adverse impacts on sustainability

Our Sustainable and Responsible Investment Policy describes how fundamental considerations of adverse impacts on sustainability are incorporated in the investment process. This policy is anchored in our adherence to the UN Principles for Responsible Investment (joined in June 2012) and also consists of norm-based and product-based screening and exclusions across our investment products. Our methodology for mapping adverse impacts on sustainability also builds on our established Sustainable and Responsible Investment Policy.

Monitoring PAI indicators

We obtain information on PAI data directly from the companies we are invested in and/or from third-party providers. PAI data is collected and assessed on a quarterly basis for existing investments or on an ad hoc basis when analysing potential new investments.

Our monitoring of PAI indicators for existing investments uses a risk-based approach, where our focus is on identifying a change of direction in the level of risk that entails an increase in the adverse impact on sustainability of an underlying investment. We assess each issuer’s PAI performance, both overall and for individual indicators. An assessment will be made of which indicators are most relevant to the company, alongside an assessment of the company’s performance for the relevant indicators. The indicators that are most relevant will vary by sector, company and geographical region.

Violations of the UN Global Compact principles and involvement in the manufacture of controversial weapons are breaches of the fund’s guidelines and will lead to the exclusion of the company.

Companies with a negative PAI performance trend, overall or for an individual material indicator, will be analysed by the ESG team and the responsible manager.Where a risk of a sustained increase in adverse impact on sustainability is identified for a company, due to poor PAI performance across multiple PAI indicators or for a material PAI indicator in the sector to which the company belongs, a dialogue is initiated directly with the company with a request to implement measures to reduce the adverse impact(s) for the specific PAI indicator(s). We can initiate such dialogue alone or in cooperation with other investors. If the company demonstrates a willingness to implement the necessary measures, the ESG team and responsible manager continuously monitor developments for an improvement in PAI performance. In addition to company dialogue, we also use our voting rights at general meetings to influence investee companies in order to reduce any adverse impact.

A company may be placed under observation if an event occurs that has a material adverse impact on a PAI indicator. A breach of norms-based principles, for example, will provide grounds for observation. The ESG team and the responsible manager will analyse the event and assess whether it constitutes a sustained increased adverse impact. In this assessment, emphasis will be placed on whether the company’s communication regarding the event demonstrates a willingness and ability to implement measures that satisfactorily remedy the adverse impact.

Reference to international standards

We will work purposefully to reduce the burden on the climate and the environment of our investment decisions in line with the Paris Agreement, preferably by setting measurable emission reduction targets in our portfolios. Our Sustainable and Responsible Investment Policy and our use of PAI are based on international conventions and norms, including:

- UN Global Compact

- UN Principles for Responsible Investment

- The OECD Guidelines for Multinational Enterprises

- The OECD Principles of Corporate Governance

- Universal Declaration of Human Rights

- The United Nations Guiding Principles on Business and Human Rights

- The ILO Conventions (?)

- The Paris Agreement under the UN Framework Convention on Climate Change

- Convention on Cluster Munitions

Consideration of the principal adverse impacts on sustainability factors in financial advice In our investment advice and recommendation of securities funds, we will inform our customers that the principal adverse impacts on sustainability factors are taken into account in the management of the funds.