As part of this work, in 2017 we began measuring the carbon footprint of our funds. This puts carbon emissions on the agenda, both for us as investors/fund managers and also for the companies we are invested in. This creates awareness, which is the first step towards change.

The carbon footprint provides a historical snapshot of the emissions from the companies in a mutual fund portfolio.

What is a carbon footprint?

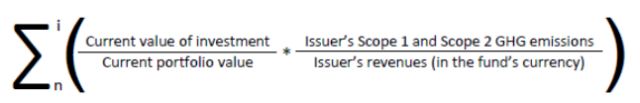

The carbon footprint (here measured by Carbon Intensity) is a way to measure the fund’s exposure to emission-intensive companies. The carbon footprint shows the portfolio companies’ emissions (CO2e over one year) in relation to their turnover (annual turnover in the fund’s currency), adjusted for portfolio weight.

How we calculate carbon intensity

The calculations are not exhaustive because they do not include all indirect emissions. For example, the company’s emissions associated with purchased electricity (which is a Scope 2 indirect emission) are included, but emissions associated with a subcontractor’s purchased electricity are not included (Scope 3). We have based our reporting on the new guidance proposed by Svenska Fondbolagens Förening and used the research firm Sustainalytics to perform the calculations on our equity funds.

The key figure assessed is the fund’s carbon intensity.

We receive a report from the analysis agency Sustainalytics showing the fund’s carbon intensity, together with an analysis showing what is contributing to it, at the sectoral, geographical and corporate level. How many of the companies that report on emissions data varies from fund to fund, and in many cases much of the data is based on estimates. In the absence of data, the model estimates emissions data* based on sub-sector affiliation or competitors if this is more appropriate.

The total carbon data at portfolio, sector and company level give us a good understanding of our carbon risk exposure and also possible ways to reduce it.

* Total greenhouse gas emissions are defined here as Scope 1 (the company’s direct emissions) + Scope 2 emissions (the company’s indirect emissions from the use of electricity, heating, etc.). Total CO2 emissions are a subgroup of greenhouse gas emissions, and for most companies CO2 will account for >90% of total greenhouse gas emissions.

Why the carbon footprint?

The carbon footprint provides the basis for assessing certain climate-related economic risks, such as the price of carbon dioxide, and facilitates influencing companies towards reduced emissions, e.g. as a result of requirements in relation to emission reduction targets, risk management, business strategies and transparency. The goal must be seen in connection with the fund’s management company’s overall sustainability work.

The carbon footprint provides a historical snapshot of the emissions from the companies in a mutual fund’s portfolio. The values will vary as the company’s emissions change, and as the composition of the portfolio changes. Exchange rate fluctuations also affect the calculation. Please note that the carbon footprint does not show the total climate impact of the investment as:

- Only some emissions are included. Indirect emissions from suppliers are not always included in the calculations, and there are seldom major emissions that can be due to the use of the company’s products.

- Emissions data from companies is not comprehensive.

- Measurements are only performed for certain asset classes.

- Emission savings through products and services are not included.

- Information on fossil reserves is not included.

- The calculations say nothing about how well a portfolio is positioned in relation to, or its contribution to, a transition to a low-carbon society.